Bitcoin Tax Calculator

Estimate ISR on your Bitcoin gains in Mexico. Educational tool with current annual tax brackets.

Key Concepts

Understanding how Mexico treats Bitcoin gains is the first step for proper tax planning.

Disposal moment

Tax is triggered when you sell, swap, or spend Bitcoin. Not when you buy or hold it.

Calculate in MXN

Gains and losses must be calculated in Mexican pesos, using the exchange rate at the time of each transaction.

Documentation is critical

Keep records of each transaction: date, amount, price, fees. Consistency in your cost basis method is important.

Progressive ISR

ISR in Mexico uses a progressive annual tariff. Bitcoin gains are added to your total income to determine your rate.

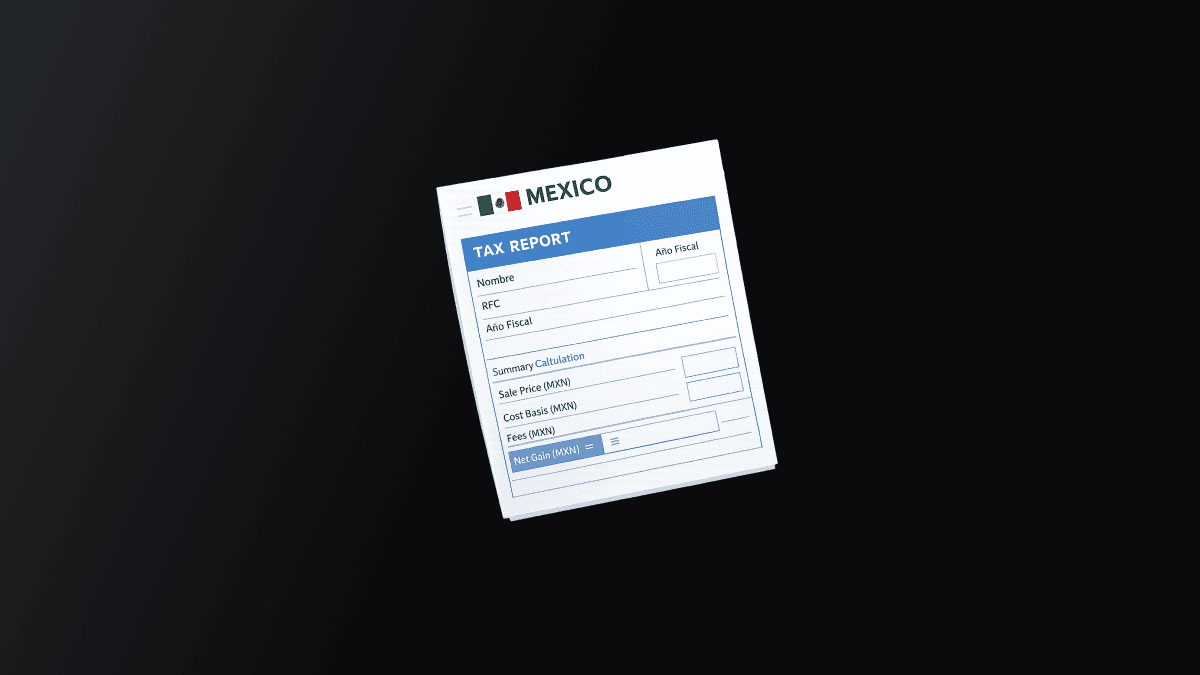

Calculator

Privacy note: This calculator runs entirely in your browser. No personal data is collected, stored, or sent to any server.

Annual Income (optional)

If you don't provide income, we'll calculate ISR on the gain alone.

Bitcoin Transactions

Enter each Bitcoin sale or disposal. A disposal includes sales, swaps, or spending Bitcoin.

Transaction 1

Learn More

How to Deduct Bitcoin Losses

Learn about the rules for offsetting capital losses in Mexico.

Bitcoin Taxes for Businesses 2026

Guide for businesses handling Bitcoin in Mexico.

Complete Guide: Bitcoin Taxes Mexico

Everything you need to know about Bitcoin taxes in Mexico.

Important Disclaimer

This calculator and accompanying content are provided for educational and informational purposes only. They do not constitute tax, legal, or financial advice and should not be relied upon as such. The calculations are estimates based on the annual ISR tariff and user inputs. Actual results may vary significantly based on your specific situation. Always consult with a qualified accountant or tax advisor before making tax decisions.